Contacts¶

For SRS registrars please note that in the IRS system we are using EPP contact objects instead of the contact attributes used in the SRS that are part of the domain object.

Warning

This is a significant technical change for SRS registrars

For EPP registrars there are a number of small differences in the way contacts are managed and the information stored for a contact, see below for further details. The behaviour for contacts associated to a domain on a transfer remains the same. When a domain name is transferred away, copies of the contacts are created under the new sponsoring registrar id and new contact ids are generated. The contacts under the previous registrar id are un-linked from the domain. See “Deleting a contact” below for details on deleting orphaned contacts.

Contact search¶

No changes in relation to what registrars can query. Registrars can only query contacts associated with their own registrar ID.

New search functionality is provided by the IRS portal. The search function in the IRS portal allows for a basic search and advanced search where you can build queries to perform complex searches.

Contact information¶

Contact type¶

An individual contact can be given a type setting when you associate it with a domain. This type setting is only configured for the associated domain.

In IRS a domain name has four types of contact associated with it:

Registrant (required)

Admin (required)

Technical (required)

Billing (optional)

Only one of each contact type is allowed.

The billing contact is a new contact type in IRS and is optional. It can be used to indicate individuals or non-individuals that are authorized by the Registrant to administer financial information for a registered domain. This contact is not published in the WHOIS.

The same individual contact can be assigned as the registrant, administrative, technical and billing contact for one or more domain names.

Postal address information (postalInfo element)¶

EPP provides the <contact:postalInfo> elements that contain postal address information.

Under SRS the supported type was “int”.

This has changed in the IRS. The IRS registry-supported type is “loc” indicating that the address is in a localized form. Eg:

<contact:postalInfo type="loc">

Organisation (new)¶

This is a new optional field in IRS. The organisation that the contact represents. If entered, the organisation name must be from two (2) to two-hundred and fifty-five (255) characters in length. All characters are valid.

Phone number¶

In IRS the phone number is changed to an optional field.

The phone number at which the contact can be reached.

The length of the phone number is based on the specified country code. For example, for country code +1 the phone number must be 10 digits long.

If required, you can add an extension number in the extension field. The extension number must be from zero (0) to ten (10) digits long.

Street address¶

SRS supported up to 2 address fields, this is increased to three in IRS.

The address at which the contact is located.

If entered, the address must be from two (2) to two-hundred and fifty-five (255) characters in length per line. All characters are valid.

Postal code/ZIP code¶

In the IRS the postal code/ZIP code validation rules for Canada, United States or New Zealand will be removed in release 7.22. With the 7.22 IRS release there will be no validation on the postal code/ZIP code field. Registrars should provide the correct values for these fields and please note validation may be introduced at a later date.

Privacy¶

Privacy is no longer set at the contact level. Please refer to the Privacy section under Domain Information above.

The optional EPP disclose element is accepted in IRS but is not functional and will be ignored by the system.

Authorisation code¶

An authorisation code is required to be provided as part of the contact create command. This is new behaviour to the existing system but is part of the EPP standard and authorisation information is a required field. Contacts are not transferred between registrars so the authorisation information will not be used.

Contact status¶

In the current SRS EPP only the ok status is supported. Under IRS all EPP contact statuses are supported.

Creating a contact¶

Contacts can be created using the IRS portal or via the EPP API.

A contact can be for an individual or a non-individual. The following guidance should be followed when creating a registrant contact:

For an individual, “Name” is used for the name of the domain name holder/registrant

For a non-individual, “Name” is used for the company or organisation name of the domain name holder. The org field can be used to provide additional information about the company/organisation if required.

Updating a contact¶

Contacts can be updated using the IRS portal or via the EPP API.

Deleting a contact¶

Under IRS there are small changes to the deletion of orphaned contacts. The IRS housekeeper deletes orphaned contact records after a defined period of time.

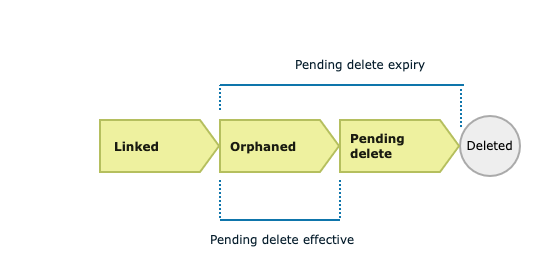

While a contact is associated to a domain it has a status of linked.

When the contact record becomes orphaned, the “pending_delete_effective” period begins (set to 60 days). At the end of this period the status changes to pendingDelete.

As soon as the contact is in a state pendingDelete the “pending_delete_expiry” continues. Note the pending delete expiry period (90 days) is the total sum of the orphaned and pendingDelete states. At the end of this period the housekeeper deletes the contact.

To restore the contact from the pendingDelete state, link (re-associated) it with a domain, the status will return to linked and the counters are reset.

Under SRS there is currently a housekeeping job which runs daily to delete any orphaned contacts over 7 days. This changes to 90 days in IRS.